Introducing a secure, user-friendly digital wallet that provides a unified space for "Rewards," "aPay," "Saved Cards," and "My Vouchers." This project aims to allow users to store, manage, and transact with digital currency and other financial tools.

Industry

Client

Service

Timeline

To design a secure, user-friendly digital wallet that provides a unified space for managing and other financial feature.

How might we create a digital wallet that maximizes user convenience by unifying all related financial features into a single, seamless platform.

Key features

Key features include seamless integration with various payment systems, enhanced security measures such as biometric authentication, real-time transaction tracking, and user incentives like cashback and loyalty rewards. The design prioritizes a smooth user experience, ensuring easy navigation, quick access to transaction history, and support for multiple currencies and payment methods.

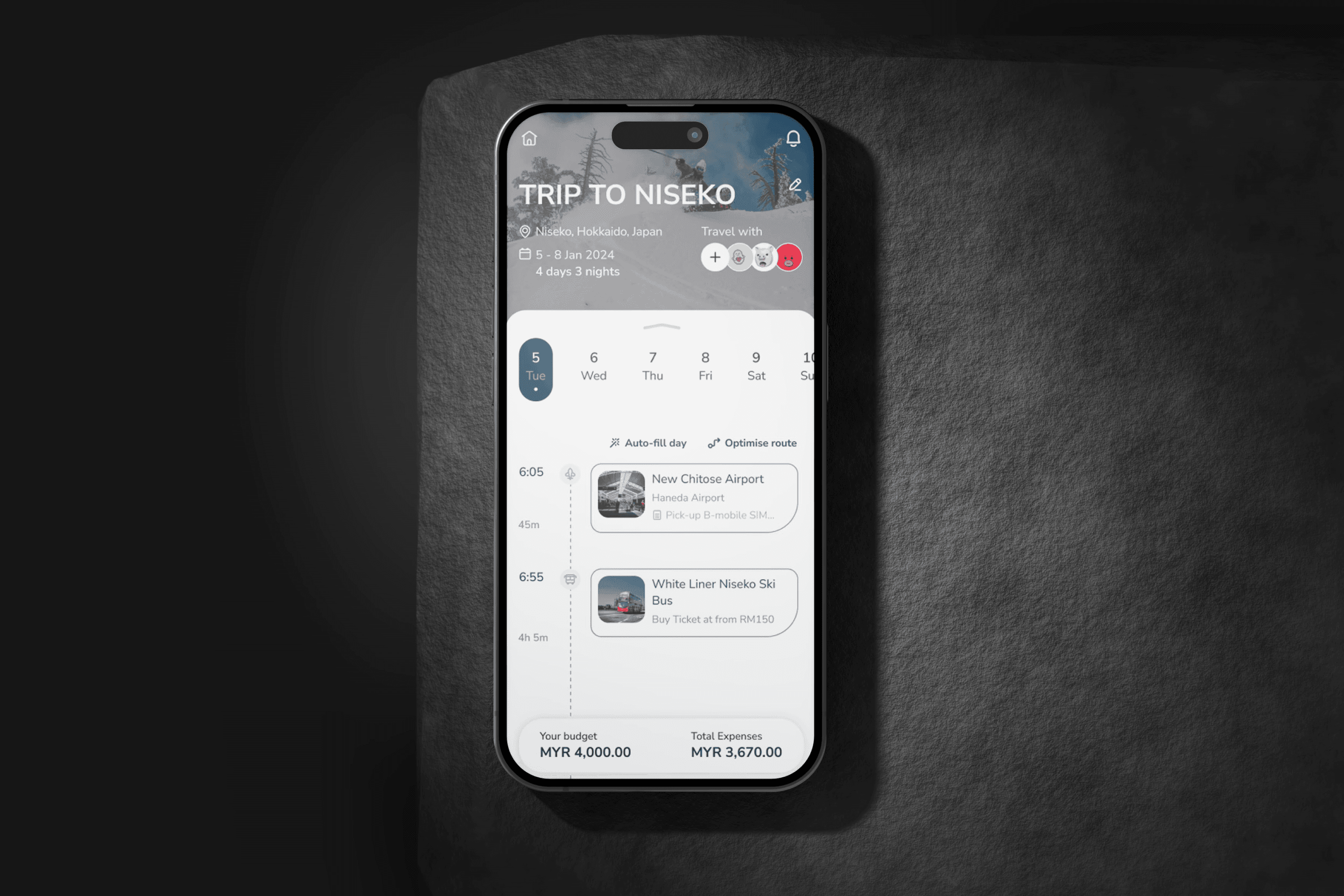

Wireframing & Iterative Design

We initiated the design process by crafting the initial wireframe, which involved exploring various design treatments and micro-interactions for the e-wallet widget featured on the homepage.

Through meticulous wireframing and iterative design, we've crafted a user-centric eWallet concept seamlessly integrating features like "Rewards," "apay," "Saved Cards," and "My Vouchers." Extensive user feedback guided refinement, ensuring optimal usability and functionality, while rigorous testing enhanced the user experience.

The concept promises to revolutionize digital payments, offering a unified platform for managing finances with convenience and efficiency. Enhanced security measures inspire trust, driving increased user adoption and engagement. Ultimately, this project not only boosts user satisfaction but also propels organizational growth in the competitive digital marketplace.

Prototype

Impact

Increase Satisfaction and Retention: Enhance customer loyalty.

Increase Engagement: Higher usage of financial services due to improved convenience.

Efficiency: Save time and improve financial management.

Revenue Growth: Boost transaction volumes and service adoption.